Estate Planning

What’s the Cost of Not Having an Estate Plan?

When it comes to estate planning, one of the biggest misconceptions is that it’s something you can put off. However, not having a plan doesn’t just cost you peace of mind—it can have real financial, emotional, and time-consuming consequences for your loved ones. Let’s break down the true cost of not having a plan and why taking action now is easier than ever with digital estate planning.

The Financial Costs

Without a will or estate plan, your assets typically go through probate, a court-supervised process to distribute your estate. Probate can be expensive, with costs often ranging between 3-8% of your estate’s value. For an estate worth $500,000, that’s $15,000 to $40,000—money that could have gone to your loved ones.

Additionally:

Court fees and attorney costs can pile up.

Assets may be tied up for months (or even years) before being distributed.

Creditors may have the opportunity to claim more of your estate during probate.

By contrast, creating a simple estate plan can cost as little as a few hundred dollars using a digital platform—and it ensures your assets go where you want them to, quickly and efficiently.

The Emotional Costs

Not having a plan doesn’t just cost money; it can create unnecessary stress and conflict among your loved ones.

Family Disputes: Without clear instructions, disagreements over who gets what can lead to strained relationships—or even lawsuits.

Uncertainty: Your family may struggle to make decisions without knowing your wishes, especially regarding medical care or guardianship for minor children.

Creating a will provides clarity, reduces emotional burdens, and helps your family focus on healing rather than untangling legal issues.

The Time Costs

Probate isn’t just expensive—it’s time-consuming. On average, probate can take anywhere from 6 months to 2 years, depending on the complexity of the estate and the state’s legal system. During this time, your loved ones may have limited or no access to critical funds.

In comparison, a properly executed estate plan bypasses probate entirely for many assets, allowing them to be distributed almost immediately.

The Solution: Digital Estate Planning

Modern digital estate planning platforms, like GoodTrust, make it easier than ever to create a will, trust, and other essential documents—all from the comfort of your home.

Benefits of Digital Estate Planning:

Cost-Effective: Affordable pricing with no hidden fees.

Time-Saving: Most wills can be completed in under 30 minutes.

Accessible: Available online 24/7, with guidance every step of the way.

Customizable: Update your plan easily as life changes.

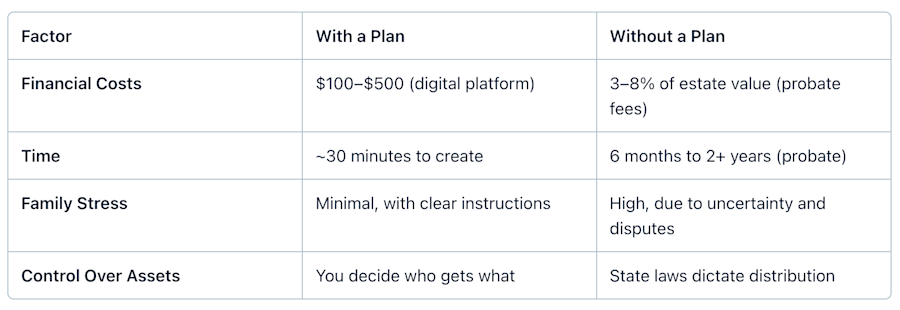

Visual: The Cost of Planning vs. Not Planning

Take Action Today

The cost of not having a plan is simply too high—not just for you, but for the people you care about most. Why leave it to chance when creating a plan is so simple and affordable?

At GoodTrust, we make estate planning accessible for everyone. Whether you’re safeguarding your family’s future, avoiding probate costs, or ensuring your wishes are honored, our digital tools are here to help.

📋 Get started today. Because the best time to plan for tomorrow is right now.

#EstatePlanningMadeEasy #ProtectYourLegacy #PlanWithGoodTrust